End of financial year

What is end of financial year?

The financial year is a time period of 12 months used for tax purposes. The Australian financial year starts on 1 July and ends the next year on 30 June. At the end of fiscal year small business owners wrap up their books and begin finalising their tax time paperwork and accounting. From 1 July through to 31 October individuals and businesses submit their tax return to the Australian Taxation Office (ATO), who use the information to determine how much tax you owe.

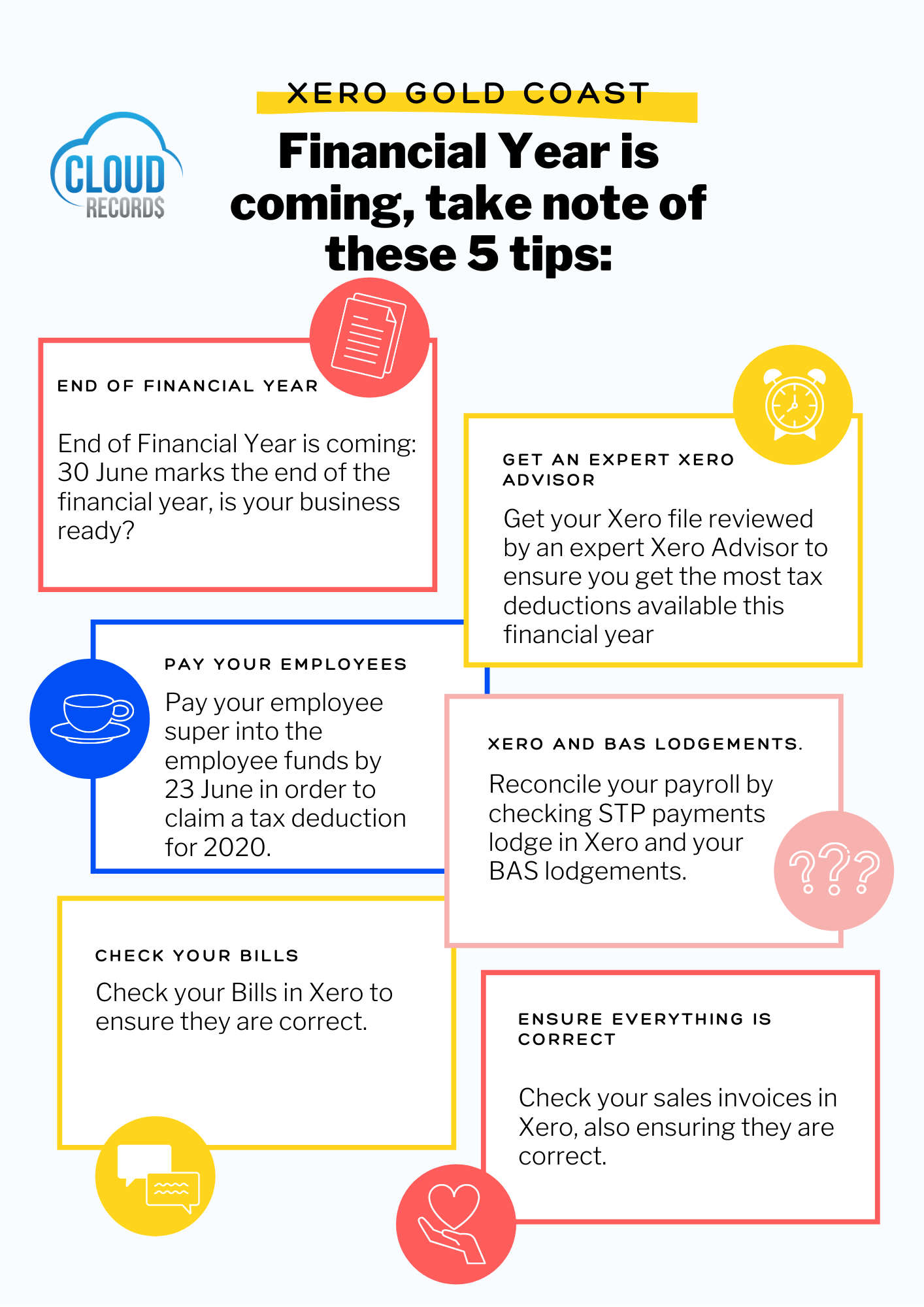

The End of Financial Year is coming: 30 June marks the end of the financial year, is your business ready?

Take note of these 5 tips:

- Get your Xero file reviewed by an expert Xero Advisor to ensure you get the most tax deductions available this financial year.

- Pay your employee super into the employee funds by 23 June in order to claim a tax deduction for 2020.

- Reconcile your payroll by checking STP payments lodge in Xero and your BAS lodgements.

- Check your Bills in Xero to ensure they are correct.

- Check your sales invoices in Xero, also ensuring they are correct.

Follow this 6 steps to make your end of financial year easy!

Step 1, Get everything in order.

Make sure you have your documentation right. Documents include:

- Invoices, bills and payments

- Banking records

- Business Activity Statements (BAS)

- Payments to employeees

- PAYG withholings

Step 2, List your tax deductions.

Items such as:

- Vehicles

- Clothes

- Travel

- Phone

- Rent

- Depreciation (Yes, depreciation of your capital assets too)

Strategies to reduce taxable income:

- Claim a deduction for prepaid expenses

- Make superannuation contributions

- Write-off bad debts or obstacles stock

Step 3, Know your deadlines

- June 30, End of financial year.

- July 28, Q4 BAS is due.

- October 31, Tax return is due.

Step 4, Lodge your tax return

It must be lodged between July 1 st and October 31 st. If you need more information, get in touch with us, we can help you to get control of your tax obligations, identify savings and of course, help you become more successful!

Step 5, Be aware of changes to tax law

There are often changes around tax compliance at End Of Financial Year, such as:

- Single touch payroll (1st of July)

- Tax brackets

- $20,000 instant asset write-off extended

- TPAR expanded to more industries

Step 6, Assess your business performance and prepare for the year ahead

- Prepare a budget

- Review wages and prices for the coming year

- To keep on the top of your business finances use XERO Accountant Gold Coast and Xero Software

Super Amnesty: the ATO is currently offering a period of 6 months where outstanding super payments can be submitted by 7 September 2020– no penalties apply. Payment plans can also be setup to pay off the old super. After 7 September a 100% penalty applies! Contact us now to discuss.

We are Xero partners with trained and certified Xero bookkeepers

Ready to take care of your business. Our Gold Coast Xero bookkeeper services are flexible so we can come to you or we can look after your bookkeeping online from our office.

Our services are the best quality and we want to create a life time partner, reason why our Gold Coast bookkeeping rates are the best, with no lock in contracts, we can always customise a fixed price package for your business.